I am new to Quickfile and getting used to the software so bear with me if I ask stupid questions.

First of all, is national insurance an expense of the business? (it is showing as an expense on my profit and loss account)

if not, how do i make the necessary changes on QF to show that?

P.S. I have already paid NI to hmrc from my business account.

Thanks in advance.

Employer’s class 1 national insurance contributions for your employees are a business expense, but your own self employed class 2 and 4 contributions are not (they’re between you as an individual and HMRC). If you’ve paid your own class 2 NI from your business account you should tag it as a transfer to drawings rather than a payment of tax.

1 Like

thank you.

I have done the first step as you said to tag as a transfer to drawings but what journal entries are required and would it appear on P&L and/or balance sheet?

There is no second step, self employed NI should not appear in your business accounts at all, neither P&L nor balance sheet.

1 Like

thanks you for the quick reply.

I am not a sole trader, I am the sole director/shareholder of the company so does the same apply to that?

thanks

Hi @SamairaPervaiz

Are the national insurance entries a result of payroll or a self assessment?

If it’s payroll, this would be a business expense. Do a search on the forum for payroll journals and you’ll find some guidance on entering this.

If it’s self assessment, tag it to the director’s loan account as it’s a company

Hi,

Its due to payroll. I will look for the relevant topic once I get a chance today. I am in the process of moving from clearbooks to QF so trying to get used to bits and bobs before cancelling my subscription with them.

Can I just clarify that its not employer’s NI but employees’ NI, so is that a business expense and should it be shown on P&L and Bal Sheet at year end?

I am getting confused from different answers.

Because it’s due to payroll, it’s a business expense. Even though it’s employee NI, it’s deducted from wages before being paid, and it’s then paid to HMRC by the business.

In terms of recording this, there’s a guide here on how to enter this info on QuickFile:

http://community.quickfile.co.uk/t/how-do-i-enter-payroll-paye-journals-and-entries/53/4?u=qfsupport

QFSupport’s reply shows the mechanics of how you enter the appropriate journals, this post of mine attempts to explain why it works the way it does:

http://community.quickfile.co.uk/t/payroll-posting-issues/5999/4?u=ian_roberts

It sounds like in your case the employer’s NI (item 1 in my list) is zero, but the principle is the same. Employee’s NI does not show separately on your P&L, it is part of the “gross wages” amount.

Hi @ian_roberts

I only have Gross salary figure, Employee NI and Net wages, the other two PAYE and Employer’s NIC are 0 for me.

Do i still follow the same procedure?

Yes, in this case the journal is just three lines rather than four: debit gross wages for the total amount before deduction of NI, credit PAYE (on your balance sheet) for the NI component and credit net salaries paid for the net wage.

The payment you made to HMRC from your bank account would balance out the PAYE nominal back to zero. For the net wage you need a “money out” bank transaction tagged as a salary payment - if you actually took the money out of the company (you paid yourself from the company bank account) then this would be in your current account, if you haven’t taken the money then it would go in the director’s loan.

The end result should be that your P&L shows an entry for gross wages and that’s all. The NI has zeroed out.

Image Removed

I have the done the above but something is still wrong. Both gross and net salaries are coming up on the p&l. What have i done wrong?

thanks

Hi @SamairaPervaiz

I’ve just taken a look at this for you. I’m not an accountant, but your payroll journal does seem to be correct.

I think the issue here is the actual payment. When the payment is made from your bank, you need to tag it to wages page, which will then balance everything out for you.

Simply enter the payment, click ‘Tag me!’, select ‘Salaries or drawings’

Enter the details:

And save. That should then balance everything out for you

thanks but there’s still something incorrect.

National insurance (for company director which i’ve already paid through my business account) is appearing as an asset on the balance sheet…how do i correct that?

I have tagged the employee national insurance as PAYE Liability but still appears as an asset on balance sheet.

There should be a video tutorial on this topic as its quite confusing…

I’ve just taken a quick look at your account, and I can’t see any gross, net or PAYE listed on either balance sheet or P&L?

It may be worth seeking help of an accountant as many accounts provide this as part of their services. If you already have an accountant, I’m sure they would be able to help you with this too.

I was playing about with the journal entries. Have added these entries back and they are showing on the p&l account however still not quite right yet. I do my payroll on an annual basis. The total salary that should appear for wages on p&l should be £5,873.76 which is shown as director’s salaries. The other two bits - net and gross appearing up are resulting in incorrect overall expenses. I have tagged the salary correctly as you described.

Can you please help with that?

That’s the only part which i feel isn’t quite straightforward on QF.

As I said above, I’m not an accountant so please only take my advice as guidance. Anything you’re unsure of should be checked with someone more qualified than me.

Apologies for the confusion, but as a director, it should be tagged to Director’s Salaries. I’ll show you how to do this below.

Let’s take a basic example.

Gross Pay: £2000.00

Employer’s NI: £200.00

Your journal would be:

Dr 7001 £2000.00

Dr 7006 £200.00

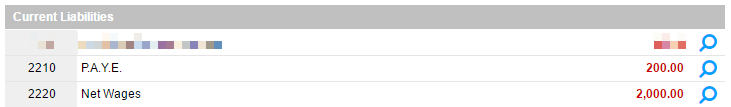

Cr 2210 £200.00

Cr 2220 £2000.00

This creates the following on the P&L:

And the following on the Balance Sheet:

Once it’s been paid to the employee, you would need to tag it as such from the bank. Enter the payment, click ‘Tag me!’, and select ‘Salaries and other drawings’:

Enter the details, ensuring you tick the director’s box:

This clears the salary from the balance sheet. Then when you pay the NI to HMRC, tag it as a payment to HMRC:

Select ‘PAYE Liability’

This clears the PAYE from the balance sheet. This should now make only the salary and PAYE on the P&L report remain.

As I said - I’m not an accountant, so I would recommend checking this with yours. Or, any accountants on the forums are welcome to add to/correct this

Thanks very much. The P&L looks fine as it should be however the net wages is still appearing on balance sheet despite tagging it. I wonder why…

The journal I’ve outlined above will only deal with Director’s Salary. If you have any other employee you’ve paid, then this could be where it comes from. The link I used further up would help in that instance.

No I don’t have any employees. I am the sole director/employee of the company