Hi @dan.l

A journal is basically a movement of values from one nominal code to another (or several at one time). You can create a journal by going to Reports >> Journals.

You would basically reverse the values produced by the invoice you entered, so the first thing I would do is grab those values.

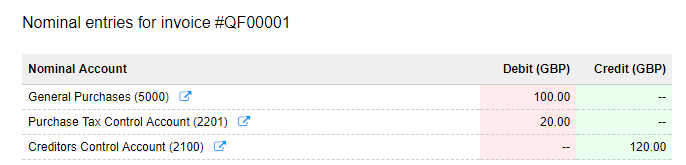

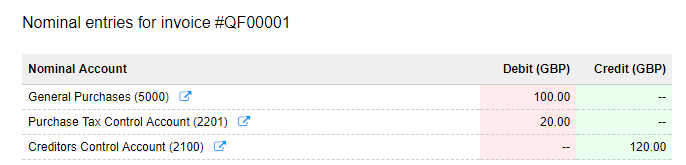

I’ve created an invoice with £100 General Purchases plus £20 VAT, dated 21st August 2017, but actually, it should be 21st July 2017 (to match your scenario).

When viewing the invoice in question, if you click on More Options, you have a Show nominal ledger entries option, which will show you a breakdown on how it affects your chart of accounts:

In my example, I have an invoice for £100 + £20 VAT. This shows up like this on the ledger entries:

Now, small note here. Normally, where the invoice is dated before the correct date (e.g. 1st January was entered, but you need it for 1st February), you would reverse it and then re-enter it, so create the journal, and then reverse the journal.

However, your situation is the opposite - your invoice is dated in December, whereas it should be in September. Because of this, you will need to enter the actual journal first (exact copy of the invoice movements), and then reverse it on the date of the invoice.

Based on that, my reversing journal would like like this:

So this journal replicates the values shown in the nominal ledger entries found on the invoice, and we use the auto reversal to reverse the entered values.

To check this, if you go to your chart of accounts and check one of the affected codes (e.g. 5000), you can see this in effect:

We have the correction on the 21st July, ‘Creating’ the invoice, and a reversal on the same date as the entered invoice on 21st August.

One thing to remember however, is VAT isn’t picked up from journals, so the system will still look at the VAT on the invoice and take it as the 21st August. The journal has simply moved the values by date, but hasn’t created anything new or removed anything that already exists.

I hope that helps.