IMPORTANT: The Year End Accounts services detailed here have since been updated and replaced with a new Price Comparison Service. The Price Comparison service enables you to compare quotes from many accountants based on price, turnaround time, ratings and reviews.

Introduction

QuickFile provide a dedicated accounts submission service to file your company accounts and corporation tax return with the assistance of a qualified accountant. This service allows you to complete your year-end obligations without spending £100s. You can order this service from within your QuickFile account. To review the latest pricing and start a new order click here. To find out more about this service, keep reading.

How does it work?

When you are ready to file your company accounts, you can initiate the process from your dashboard or the pricing screen. The initial phase consists of a 4 part checklist that will allow you to prepare your accounts for review.

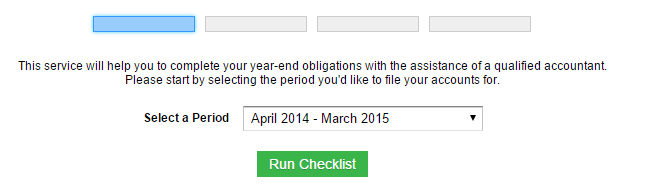

Selecting an accounting period (Part 1)

You will initially see a drop-down list with the accounting periods for which you can file. If the periods don’t correlate with your actual accounting dates you will need to change the year-end date in your company settings.

Verifying your bank account balances (Part 2)

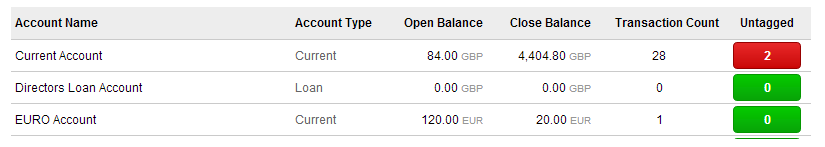

Once you have selected an accounting period, QuickFile will bring up all your bank accounts along with the opening and closing balances for the selected period. You will need to check the balances against your paper statements, or verify them online or over the phone with your bank before proceeding.

You will also see here the total number of transactions entered on each bank for the accounting period. If any of the bank accounts have transactions that are untagged, these will be highlighted in red. You will need to go into the bank and tag these before proceeding.

Verifying your accounting transactions for the period (Part 3)

You will see here a balance of all the transactions made on your nominal ledgers for the accounting period. These figures don’t include opening balances, which will be considered later. This report is similar to the chart of accounts that you can access in the reports section of QuickFile. All entries made for your sales, purchases, expenses, overheads, assets and liabilities will be reflected here.

Additional information to assist the accountant (Part 4)

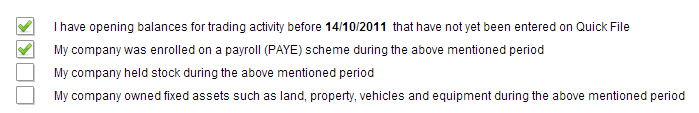

The final part of the check-list will ask you if any additional circumstances apply to your business, e.g. payroll, stock, assets etc. Just tick the relevant options that apply to your business and continue to the final payment confirmation screen.

Choose an Accountant

You will now have the opportunity to compare the fees and ratings for a number of accountants. Once you have chosen an accountant you will be invited to make a payment to them directly.

What Next..?

Once your order has been confirmed your chosen accountant will review the details on your account and issue a checklist for any further documentation required to complete the work.

How long will it take to complete my accounts?

It typically takes one to two weeks to produce a set of accounts but this largely depends on how quickly you are able to provide the necessary information. You would be advised to submit your order as early as possible to leave sufficient time to complete the work. If you are struggling to find any of the requested information, then please don’t hesitate to contact us.

What happens when the accounts are complete?

Once your accounts have been prepared you will be asked to sign and return a copy. This can usually be done electronically using our E-Signature software. Once the accountant has receipt of the signed accounts they will submit a copy to Companies House and file the necessary returns with HMRC.

I still have doubts...How can I get more help?

If you have any questions before placing an order you can post a general query in our community area, we usually respond within a few working hours. If you have an existing order with us, simply log into your checklist and open a new support ticket here.