Hi - This may be a silly question, but I have a client that has paid for a windscreen repair which was partially covered by insurance. The insurance company do not pay the VAT as he can reclaim this on his VAT return. So he has paid his £100 excess plus the VAT on the whole job, Therefore the VAT rate he has paid is greater than 20%. I believe we used to be able to add additional purchase VAT rates in advances settings for occasions like this but I can no longer see that feature?

Hello @dassawyer

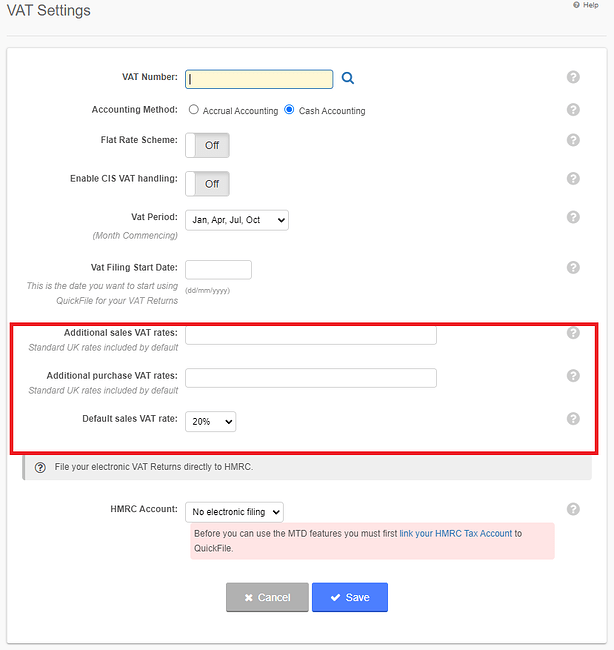

We recently changed the interface in the Settings Menus (tabs).

It was decided that the vat rates would be better off being moved to the vat settings (Reports > Vat Returns > Settings).

Hi Steve,

Thank you! Makes perfect sense.

I wouldn’t use that option on occasions like this since it makes the invoice footer look odd, saying “VAT at 60%” or whatever. Rather I’d make a two line invoice.

For example if the total job cost was £300+VAT, the customer is paying £100 plus all the £60 VAT and the insurance is paying the other £200 then I’d make two lines

- Cost of repair 300, VAT rate 20%, line total £360

- Less net paid by insurance -200, VAT rate 0%

The footer then says net £100, VAT@20% £60, grand total £160.

Presumably you then invoice the insurer separately for the remaining £200 @0% VAT.

Edit: sorry, I read “client” as if you were trying to invoice your customer for the repair. But the same mechanism works for purchases and saves you inventing a load of non-standard rates.

This topic was automatically closed after 7 days. New replies are no longer allowed.