From 1st March 2021, VAT registered businesses operating in the building and construction industry will need to change the way they collect and report VAT.

The new changes will require businesses that are receiving a service from a CIS registered contractor to pay the VAT to HMRC, rather than paying the VAT to the supplier. These changes will apply only to UK VAT registered businesses or individuals supplying services under the Construction Industry Scheme (CIS).

Enabling CIS VAT handling in QuickFile

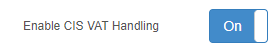

By default the CIS VAT options are disabled and must be switched on in your “VAT Settings” area. You can find this under the “Reports > Vat Returns” from the main menu.

You will then see an option “Enable CIS VAT Handling”, which should be toggled “On” and then saved.

Invoicing for sub contractors

For a sub contractor invoicing the main contractor the invoice should be for the NET value excluding any VAT. The VAT is entered onto the invoice however when the “Apply CIS reverse charge” box is checked it will be reversed off again.

The main contractor will then pay the NET amount to the sub contractor to settle the invoice. Taking the above example, on the sub contractor’s VAT return they will see £1,000 in box 6. No VAT figure will be entered in box 1.

Invoicing for main contractors

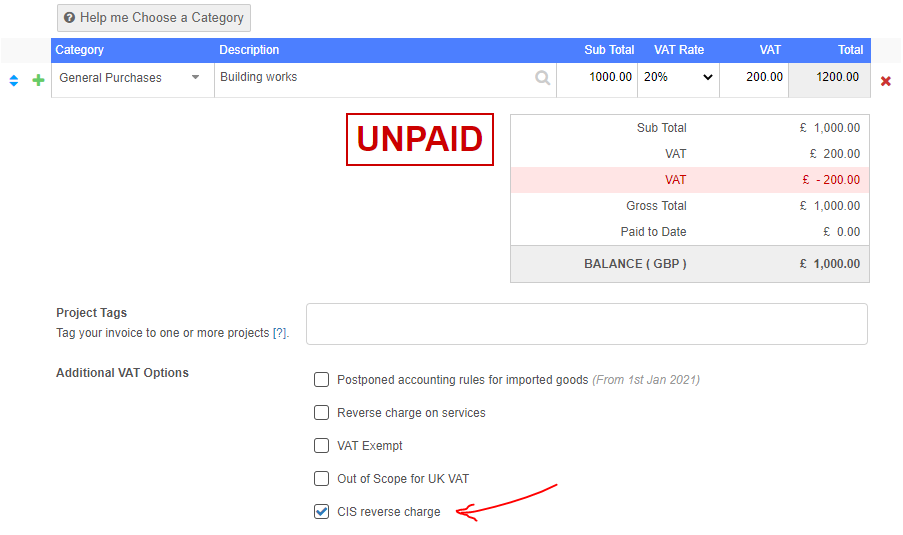

The main contractor receiving services from a sub contractor will pay the net amount and will need to report the VAT themselves on the VAT return using the domestic reverse charge mechanism. When entering the purchase invoice, the net amount along with the standard VAT will need to be entered. The “CIS reverse charge” box would then be checked to reverse the VAT on the purchase.

The input VAT on a reverse charge purchase will then appear on box 4 of the VAT return, but will be reversed in box 1, resulting in a net zero liability. The net amount of the purchase invoice will appear in box 7 of your return, as would normally be the case.

VAT return breakdown

When you drill down on the box totals in your VAT return you will be able to isolate those items which have a CIS VAT option applied. When you export your VAT return workings these items can also be distinguished by the VAT code “cisrc”.

The VAT return example below highlights the domestic reverse charge reported by the main contractor.