A profit and loss (P&L) report is usually calculated from all your receivable and payable invoices regardless of whether the invoices have been paid or not.

A cash based P&L report however is calculated from your incoming invoice payments and outgoing purchase payments and then stratified by nominal code, depending on how those invoices were categorised. The report will look much the same as a standard P&L, but the underlying calculations may be different.

When to use a cash based P&L

A cash based P&L is typically used by smaller businesses that want to get a better view of their cash position. Such businesses may also be eligible to report their earnings and calculate their tax liability with HMRC on a cash basis rather than accrual.

How are the calculations made?

The cash based P&L report takes a little bit more time to generate than the standard accrual based P&L report. This is because we need to pull information from a few different sources. Here’s how we make the calculations:

- First we retrieve all your sales and purchase payments over the reporting period.

- We then analyse what invoices these payments were attached to.

- The itemised lines on each invoice are further analysed to detemine the nominal codes to which any itemsed amounts were assigned.

- Once the invoice allocations are determined an additional check is made to find any direct to bank taggings, i.e. where amounts are tagged from a bank entry directly to a nominal code.

The report is compiled and delivered as a snapshot. You will need to refresh the report should any underlying information change within the reporting period.

Drilling down on the data

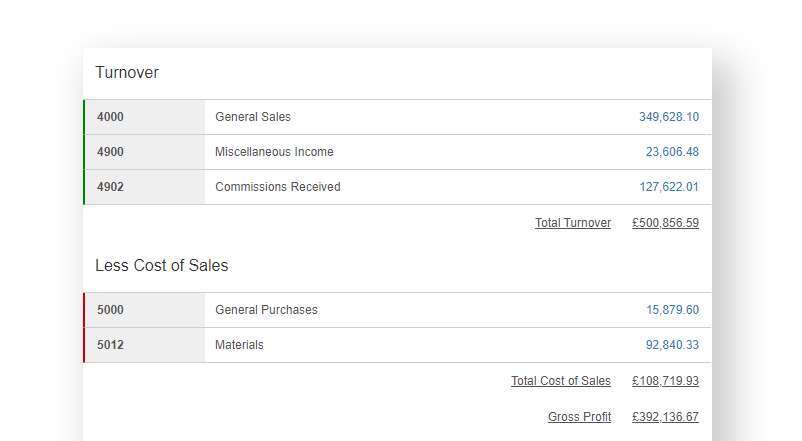

The report is categorised by nominal code and as with the standard P&L it will show broaded totals for the turnover, cost of sales and expenses to arrive at a net profit amount.

You can drill down on the nominal totals to see a list of payments that make up those totals. You can further drill down on the payment allocations to see the invoice(s) to which the payment is assigned and the nominal entry breakdown.

Other things to note

- The cash based P&L is available for sole traders and non-incorporated partnership accounts that have a power user subscription or are lined to an Affinity account.

- For VAT registered users amounts are calculated net of VAT as VAT is a balance sheet item.

- Payments on account (prepayments) reside on the balance sheet and will not appear in the profit and loss report.

- Journals are included when a matching contra entry to a bank account is identified.

- Each report is a point in time snapshot. Any change to the underlying accounting records in that period will require the report to be refreshed.