Please note: This is an experimental feature, the reports generated here may automatically be removed after a period of time.

Making Tax Digital (MTD) is an ongoing government programme designed to simplify the way businesses and individuals report their taxes. If you’re not familiar with MTD you can get a list of the key points right here. One of the features of MTD will be the introduction of Periodic Updates.

What are Periodic Updates?

MTD will eventually replace the current Annual Self Assessment scheme with one off quarterly summaries, referred to as Periodic Updates. Typically a business will submit 4 updates per year which will be rounded off with an end of year statement. There’s no need to worry just yet, the government recently pushed back the timetable for implementation to beyond 2020, but as always we are keen to keep users informed and stay ahead of the curve.

The Periodic Update will consist of a total turnover figure, minus a breakdown of expenditure (e.g. cost of sales, advertising, rent etc). The report can be calculated on either a cash or accrual basis. A typical Periodic Update report will consist of around 15 lines. You can find out more about the information that will likely be required here.

Create a Periodic Update in QuickFile

QuickFile have developed a dedicated MTD reporting area so that users can get a feel for how Periodic Updates will work. It should be noted that this report is purely experimental and will evolve as HMRC tighten up their specifications. The reports or data created here will not be submitted to HMRC.

You can find the MTD Periodic Update section under reports (Reports Menu >> All Reports), just scroll down to the bottom.

![]()

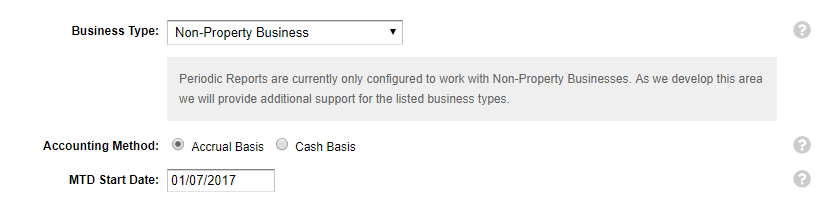

If this is your first time visiting the MTD reporting area then you will be prompted to provide some preliminary information that will determine how your reports are calculated. Don’t worry too much about the settings here, they can easily be changed later. The main thing is to decide whether you want your reports to be calculated on a cash basis (i.e. when payments are made) or accrual basis (when invoices are raised).

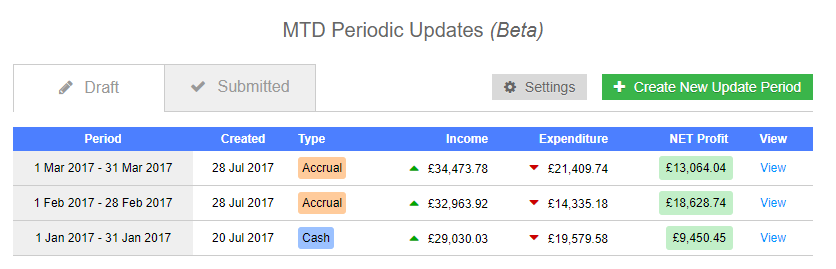

Within the main Periodic Updates section you will see two tabs for your “Draft” and “Submitted” reports.

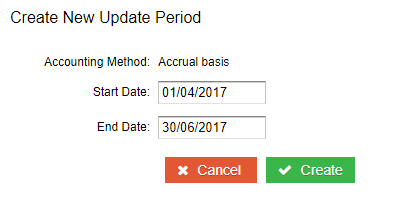

You can create a new Periodic Update report by clicking the green button Create new update period. You will then be prompted to enter the date range you’d like the report to cover.

Your new draft report should now be ready to view.

Analysing the Periodic Update Report

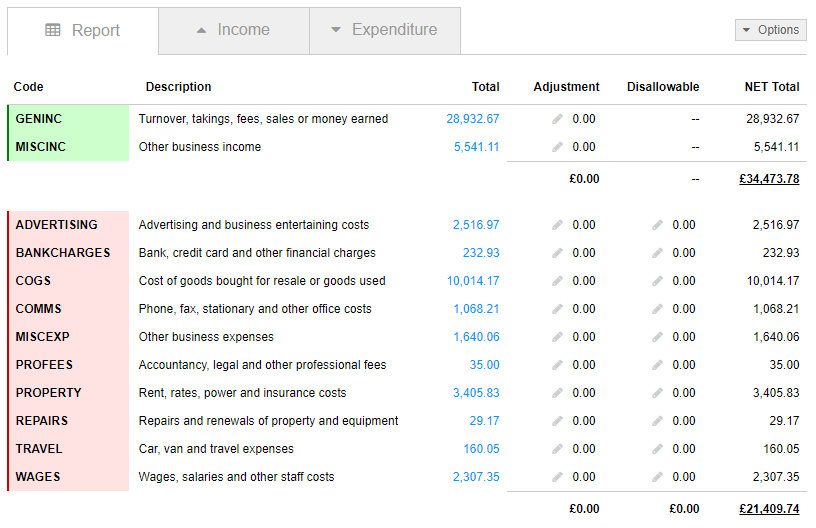

In the first tab on the Periodic Report will see a breakdown of the summary totals. These totals are grouped in accordance with the nominal codes utilised within your invoices. The categories shown here are those recognised by HMRC for the purpose of MTD reporting.

The “Income” and “Expenditure” tabs will allow you to view all the payments (cash accounting) or invoices (accrual accounting) that are included in your report. From the “Report” tab you can also click the linked total for each category to filter all items that make up that figure.

You can remove the filter simply by clicking on the close icon on the yellow filter label.

You can also click the total amount for any payment or invoice to get a breakdown of the allocated amounts. For example, you may have an invoice with multiple lines that are allocated to different HMRC reporting codes.

How are the summary totals grouped?

Each nominal code on your Chart of Accounts is mapped to a HMRC code for summarising the totals. As we develop the Periodic Update report we will provide additional controls so that you can specify exactly which HMRC summary each of your nominal codes will map to.

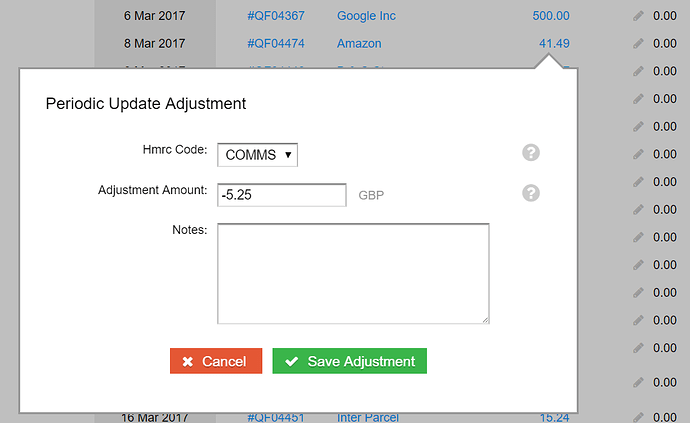

Making adjustments

QuickFile provide two ways in which adjustments can be made on your Periodic Update report. You can either apply adjustments to the total figures listed under the Report tab or you can adjust specific items under the income and expenditure lists. In each case you will see a column on the report specifically for adjustments.

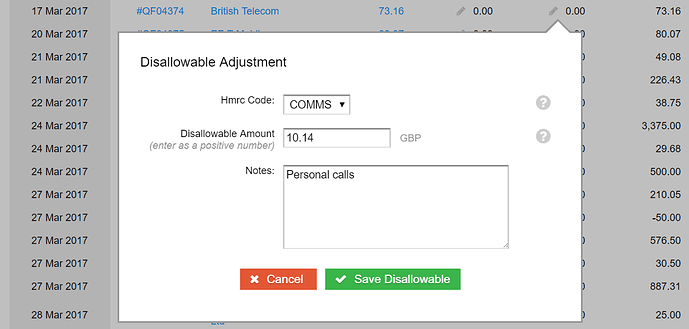

Disallowables

The Periodic Report will allow you to specifically declare any disallowables. Disallowables are where a part of your expenditure was not for business purposes and therefore not tax deductible. Adding disallowables will increase your overall taxable profit.

A disallowable adjustment can be made on the main report or applied to a specific invoice or payment (as with adjustments). On both the main report and expenditure tabs you will see a column specifically for entering disallowable adjustments.

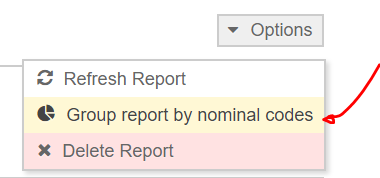

Grouping by Nominal Code

To help understand how items are grouped you can also switch your Periodic Update report to “Group by nominal code”. You will find this option in the “Options” menu, visible in the top right.

The group by nominal code option can provide a very useful way to extract a cash based Profit & Loss report for your business. Even before MTD is fully rolled out you can use this feature as a reporting tool to help you complete your self assessment.

Final Points

We felt that it may be useful to include a few extra points here that will help you to understand the figures in your report.

- Invoices (or payments linked to invoices - for cash basis) that include items posted to the balance sheet (nominal codes 1 - 3999), for example capital expenditure will not appear on this report. The Periodic Update report is concerned only with P&L activity for the basis of calculating tax.

- The Periodic Update report will not automatically pick up new items added after the report was created. To do this you will need to go to the “Options” menu and select “Refresh Report”.

- At this time the Periodic Update report will not automatically bring forward unreconciled entries from earlier reporting periods. This functionality will likely be added closer to when the Periodic Update report becomes mandatory.

- The MTD reporting tools in QuickFile will allow you to create one single report for a given period. You can update this report any time by using the refresh option (as described in the previous point).

- No data within the MTD reports will be sent to HMRC.

Of course if there’s anything else we’ve missed here, please don’t hesitate to get in touch.