Please Note: As the transitional period has now ended, digital businesses will no longer be able to use the UK’s VAT MOSS service. HMRC has issued guidance on what to do next.

Introduction

From the 1st January 2015 a number of changes to the European Union (EU) VAT rules will become effective. These rules relate specifically to the “Place of supply” for a number of digital services made from business to consumer (B2C).

From the 1st January the place of taxation will be deemed to be the location of the consumer and qualifying digital services will be taxed at the VAT rate applicable to the consumer’s member state. You can find the official GOV.UK VAT MOSS guidance notes here.

VAT: supplying digital services and the VAT Mini One Stop Shop

Why were these changes brought in?

The VAT MOSS changes were introduced to limit the practice of large organisations situating their office address in jurisdictions with low VAT rates (e.g. Luxembourg) while the vast majority of their trade is with citizens based in other member states. This was achieved by requiring that the VAT rate be set at the consumer’s local VAT rate rather than where the company is based. Unfortunately this has the consequence of increasing red tape for smaller businesses who are less able to adapt to the new reporting requirements, i.e. distinguishing sales made to each jurisdiction.

Originally the rules sought to ensure that those businesses selling digital services in the EU acquired a VAT registration number in each respective member state. Clearly this would have caused serious administrative headache for many small and micro entities so a “VAT Mini One-Stop-Shop (VAT MOSS)” was proposed whereby those businesses with qualifying sales could report their figures for each jurisdiction within a single portal.

What type of digital services are affected?

In general these rules apply to the following types of digital services sold from business to consumer. This is by no means an exhaustive list but it will give you a general idea if you will be affected by the legislation.

Broadcasting

Includes the supply of television or radio programs to a schedule by the person that has editorial control of those programmes.

Telecommunications

Includes the service of sending or receiving signals by wire, radio, optical or other systems - and includes fixed and mobile telephony, fax and connection to the internet.

E-services

Includes video on demand, downloaded applications (or ‘apps’), music downloads, gaming, e-books, anti-virus software and on-line auctions.

How to account for the sale of digital services to EU consumers?

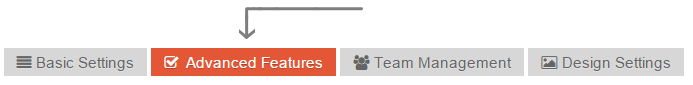

The first thing you will need to do is ensure that you have preconfigured the appropriate VAT rate in your Company Settings area. From the Account Settings menu select “Company Settings”, now click the “Advanced Settings” tab.

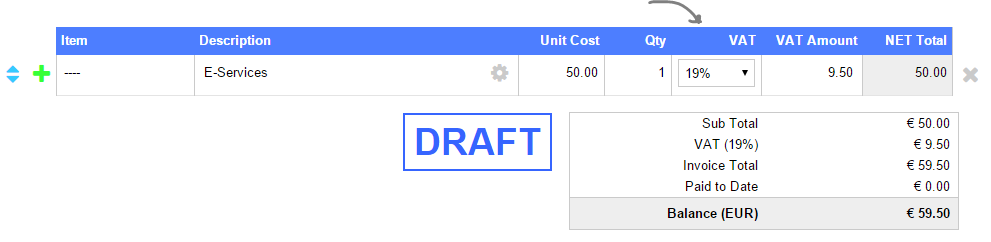

You should now see a list of additional sales VAT rates you can have appear on your invoices, by default this will be empty. You only need to enter the additional non-UK VAT rates applicable to the customers you will be invoicing under the VAT MOSS rules.

Now just save these settings.

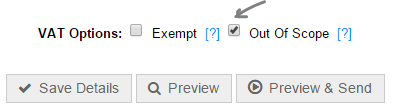

Whenever you are levying VAT at the consumer’s local rate, the sales invoice would be out-of-scope for UK VAT. You will see an out-of-scope check-box on your sales invoice, just above the save buttons.

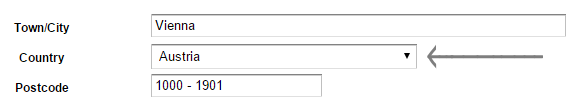

It should be noted that this out-of-scope option will only appear if the client you are invoicing has their country set as non-UK. You can change the client country within the client modification screen.

Now you will be able to create a sales invoice, apply a foreign VAT rate and ensure that the invoice is excluded from your own UK VAT return.

How do I report VAT accrued within different jurisdictions?

At the time of writing QuickFile does not support individual VAT reporting on a per-country basis. In this regard we will await further developments on the VAT Mini One-Stop-Shop which is currently in beta testing phase (December 2014).

VAT reporting does often have many complexities and changes to the core VAT accounting methods in QuickFile must be carefully planned and rigorously tested. We will seek to provide an accounting solution that will simplify VAT MOSS reporting but this will likely become available only when we have had time to fully explore the options and test the government gateway tools.