QuickFile provide a simple to use price comparison service that allows you to check real-time quotes from multiple accountants in order to finalise your year end accounts and tax returns. You can use this service to check live pricing, ratings and reviews and to make the most informed decision about who you appoint to assist you with your year end formalities.

Getting Started

If you are a Limited company and you have saved your company number to QuickFile, we will automatically remind you when your year end accounts are due to be filed at Companies House which will include a link to the price comparison service. You can also access the price comparison service directly from your dashboard by clicking the link in the blue banner.

You can also access this service from the button in the top right “Need help with your accounting?”.

All the offers made by accountants on QuickFile are done so on that basis that your bookkeeping is fully up to date for the period you wish to file. We’ll ask you to verify this before proceeding to review the live quotations, these series of pre-checks are covered in the next few sections.

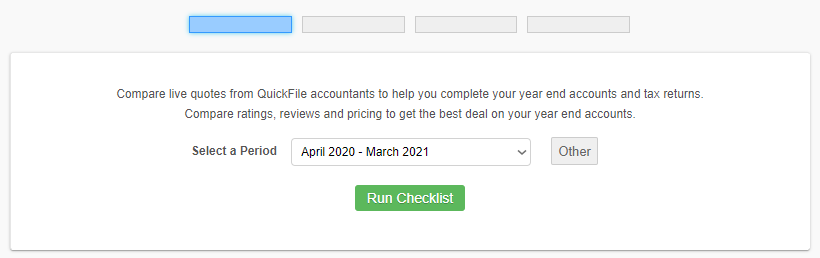

Selecting an accounting period

You will initially see a drop-down list with the accounting periods for which you can file. If the periods don’t correlate with your actual accounting dates you will need to change the year-end date in your company settings.

For sole traders we will take your year end date to determine which tax year you wish to file for.

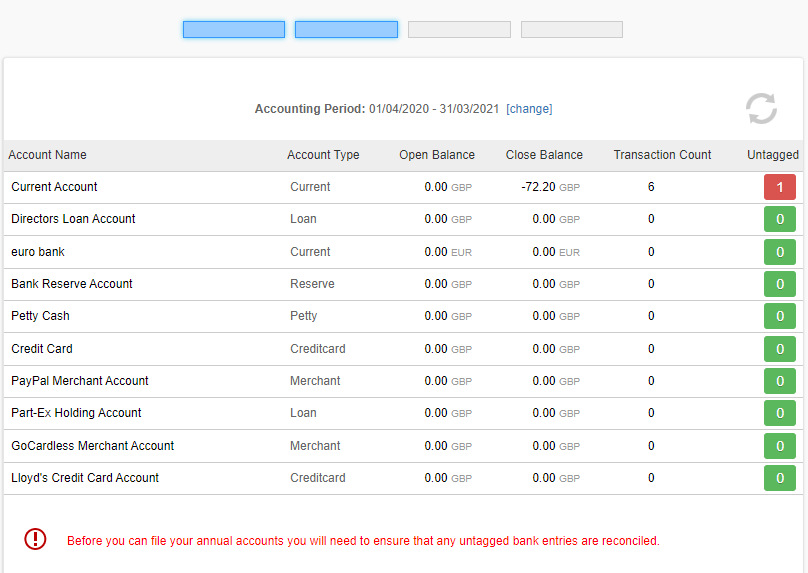

Verifying your bank account balances

Once you have selected an accounting period, QuickFile will bring up all your bank accounts along with the opening and closing balances for the selected period. You will need to check the balances against your paper statements, or verify them online or over the phone with your bank before proceeding.

You will also see here the total number of transactions entered on each bank for the accounting period. If any of the bank accounts have transactions that are untagged, these will be highlighted in red. You will need to go into the bank and tag these before proceeding.

Verifying your accounting transactions for the period

You will see here a balance of all the transactions made on your nominal ledgers for the accounting period. These figures don’t include opening balances, which will be considered later. This report is similar to the chart of accounts that you can access in the reports section of QuickFile. All entries made for your sales, purchases, expenses, overheads, assets and liabilities will be reflected here.

Additional information to assist the accountant (Part 4)

The final part of the check-list will ask you if any additional circumstances apply to your business, e.g. payroll, stock, assets etc. Just tick the relevant options that apply to your business and continue to the final payment confirmation screen.

For Sole Trader accounts we’ll ask you to declare any additional employed roles and directorships you hold. Furthermore if you receive income from an investment property, we’ll ask you to clarify this here. This information is used to determine what (if any) additional tax return supplements must be completed.

Choosing an accountant

You will now have the opportunity to compare the fees and ratings for a number of accountants. These offers are made directly by accountants who are familiar with QuickFile and have the necessary expertise to complete your year-end accounts and tax returns. We provide inline reviews and ratings to help you make the most informed decision, we recommend that you factor these in when choosing an accountant.

Making a payment

Once you select an accountant from the comparison service, you will see one or more payment options. All payments for accounting services are made directly to the accountant. Any additional card processing fees will be presented at this stage before you are prompted to make a payment.

What Next..?

Once your order has been confirmed your chosen accountant will review the details on your account and issue a checklist for any further documentation required to complete the work.

How long will it take to complete my accounts?

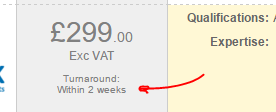

Each accountant will provide a quoted turnaround time required to complete a set of accounts. These turnaround times can be viewed on the main list of accountants that appear within the comparison service.

This is a quoted average and other factors may influence how much time is needed to prepare a set of accounts, such as accuracy of the bookkeeping and delays supplying supporting information or fulfilling ID checks. In all cases we recommend that an order is placed well in advance of your filing deadline to ensure ample time should there be any deliberation.

What happens when the accounts are complete?

Once your accounts and tax return have been prepared you will be asked to sign and return a copy. This can usually be done electronically using E-Signature software. Once the accountant has receipt of the signed accounts they will submit a copy to Companies House (Limited companies only) and file the necessary returns with HMRC.

If you are a Limited Company you can independently check that your filings have been made directly with Companies House. For CT600 tax returns we would recommend you log into your HMRC online account and activate the Corporation Tax online service.

I still have doubts...How can I get more help?

If you have any questions before placing an order you can post a general query in our community area, we usually respond within a few working hours. If you have an existing order with us, simply log into your checklist and open a new support ticket here.