Making Tax Digital (MTD) is now live. If you are a VAT registered business from April 8th 2021 you must submit your VAT Returns using the MTD Gateway. Fear not, if you are already using QuickFile to manage your accounting, the setup procedure is very simple.

Enrolling for Making Tax Digital (MTD)

Before you can file your VAT Return on the new MTD system you must first enroll for MTD within your HMRC Tax Account.

- First sign into your HMRC Tax Account.

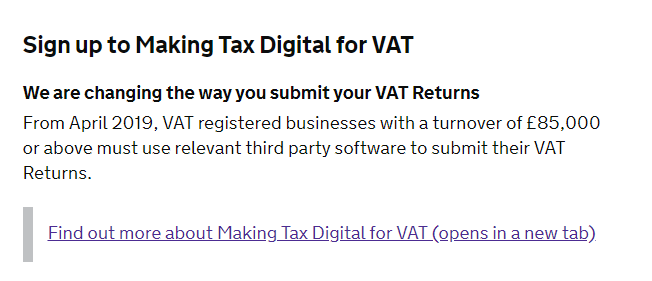

- On the overview page you will then see a link “Sign up for Making Tax Digital for VAT”. Click this link to proceed.

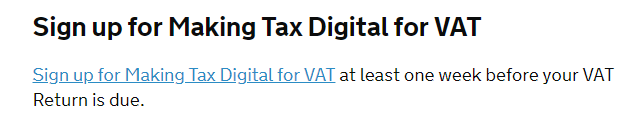

- You should then see another link as follows:

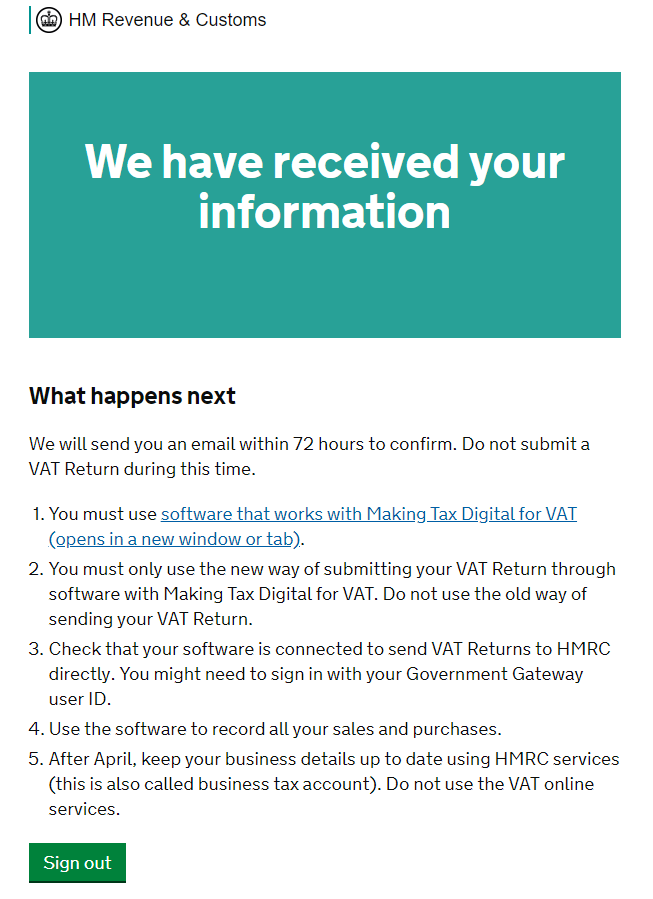

- You will be taken through a series of forms where you’ll provide additional information about your business. Once you reach the end you should see a confirmation message similar to the one below.

- You may now sign out of your HMRC Tax Account.

Important: You must wait for HMRC to send a confirmation email that your enrollment process has completed before you can view your VAT Obligations and file your VAT Returns on QuickFile. You may link your Tax Account in QuickFile, but none of the MTD reports will be accessible until HMRC confirm your application.

To find out how to link your Tax Account and setup for MTD on QuickFile please refer to the guide below: