It’s not an uncommon scenario, you’re bringing your accounts up to date and realise that you’ve been posting an expense to the wrong nominal code all year, you have 100s of invoices posted to “Office Equipment” when it should have been “IT Consumables”.

Before you had to either transfer the total as a single journal or manually change potentially 100s of invoices. the first option was always the more sane approach, although something of a compromise!

Introducing the recoding tool

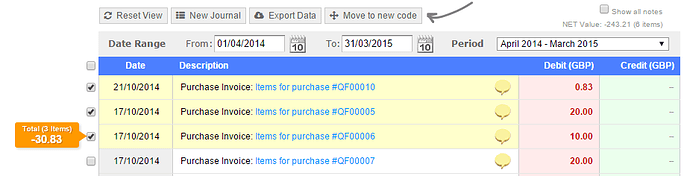

From your chart of accounts page (Reports >> Chart of Accounts), you can now drill down into the ledger and move up to 50 items at a time in bulk using our new re-coding feature. Just select the applicable entries and click the button at the top Move to new code.

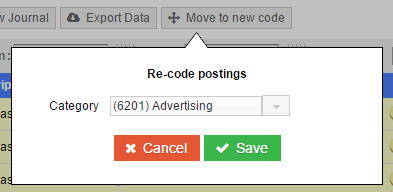

Once you click the button a dialogue will appear asking where you want to move these transactions to.

Click save and within a few seconds, the entries on the ledgers will have been updated, along with any corresponding invoices or payments.

Another use for this tool is to allow bank transactions posted to the wrong bank account to be relocated (assuming the currency is the same).

A few limitations

There are a few limitations to this tool but this should only affect a small number of scenarios.

- Entries on purchase codes can only be relocated to other purchase codes, likewise for sales.

- You cannot re-code entries made on control accounts (e.g. debtors, creditors, VAT etc), the core accounting system relies on these entries for various reporting requirements.

- Bank entries can only be relocated to other bank accounts denominated in the same currency. E.g. you can’t bulk relocate entries in a EUR account to a USD account.

Enjoy!