With the implementation of Making Tax Digital (MTD) for VAT, businesses over the VAT threshold are now required to maintain and submit their VAT records digitally. If you are managing your accounts in QuickFile we will automatically calculate your VAT Return and allow you to submit the return directly to HMRC using the new MTD interface.

Please note: VAT Bridging is accessible at no extra cost for those with an active Power User Subscription (£60 + vat per year) or Affinity managed account. On the free tier you will be able to file your first Bridging VAT Return at no cost, after which you will need to obtain an Affinity or Power User Subscription.

What is VAT Bridging?

You may be using software that does not support the new MTD filing options, or perhaps you depend on Excel to manage your sales and purchase ledgers. This is where VAT Bridging software comes in. VAT Bridging Software does as the name would suggest, it creates a bridge between your existing accounting software and HMRC’s new MTD filing interface.

The QuickFile VAT Bridging Module

We have developed a complete VAT Bridging solution for those businesses that are not using QuickFile to manage their accounts but would like a simple and convenient way to file their VAT returns without needing to change their accounting software. The QuickFile VAT Bridging module will allow you to upload your Excel or CSV backing report into QuickFile and automatically populate boxes 1-9 of your VAT return before submitting it electronically to HMRC.

Step by Step

Follow the steps below to enable the VAT Bridging Module and file your first VAT Return in QuickFile.

-

If you have not done so already you must first register a new account with QuickFile. Make sure to check the box on the registration screen to state that you are VAT Registered.

-

From your new QuickFile dashboard in the top menu click on the “Reports” tab followed by the “HMRC” option.

-

If you see a button “Activate MTD Features” click the button and you should then see an option to “Connect a new Tax Account”.

-

Make sure to check the option to connect to an “Organisation” type account and enter a name for your Tax Account (defaults to your business name).

-

You will now be redirected to HMRC where you must log into your Tax Account and authorise the connection with QuickFile. Once completed you should then see your Tax Account listed in QuickFile.

-

Now in the top menu select “Reports” then “VAT Returns”. In the VAT Returns overview screen select the button “VAT Settings”.

-

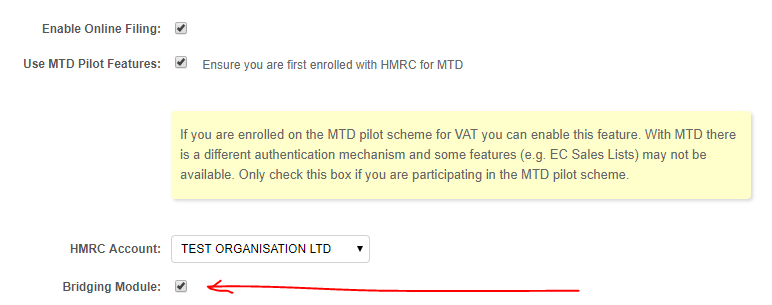

In your VAT Settings ensure online filing is enabled and the option to use MTD is checked. You will also need to select the Tax Account you connected in the previous steps. Finally check the box to enable the Bridging Module.

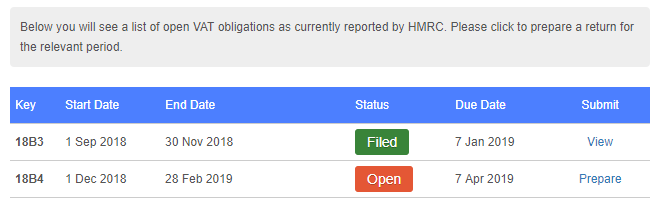

- Now go back to the main VAT Returns page and click the button to “Create a New VAT Return”. On the VAT Return screen we will attempt to connect to HMRC to determine your open VAT Periods. Simply select the period for which you would like to submit to HMRC.

-

As this is your first Bridging VAT Return in QuickFile, you will need to tell us about the spreadsheet report you will be uploading. You should now see a link to setup your spreadsheet mappings. Click this link to go to the mapping configuration page.

-

The QuickFile VAT Bridging Module can work with single or multi sheet Excel files (xls, xlsx) or CSV files. If you intend to upload a multi sheet Excel file we will need to know the exact name of the sheet where your VAT box totals can be located. You can enter this into the first input box with the label “Sheet Name”. Don’t worry if you’re using a single sheet Excel file or CSV file, you can leave this box blank.

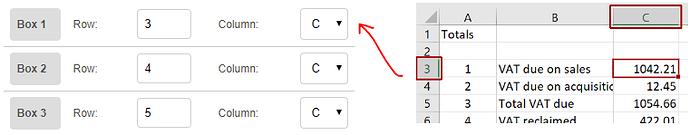

- Further down you will be prompted to enter the row and column locations for each of the VAT Return box totals 1 through to 9. Be careful here to map the exact locations of the numerical values, try to ensure those values are free of any additional formatting such as currency symbols or comma separations.

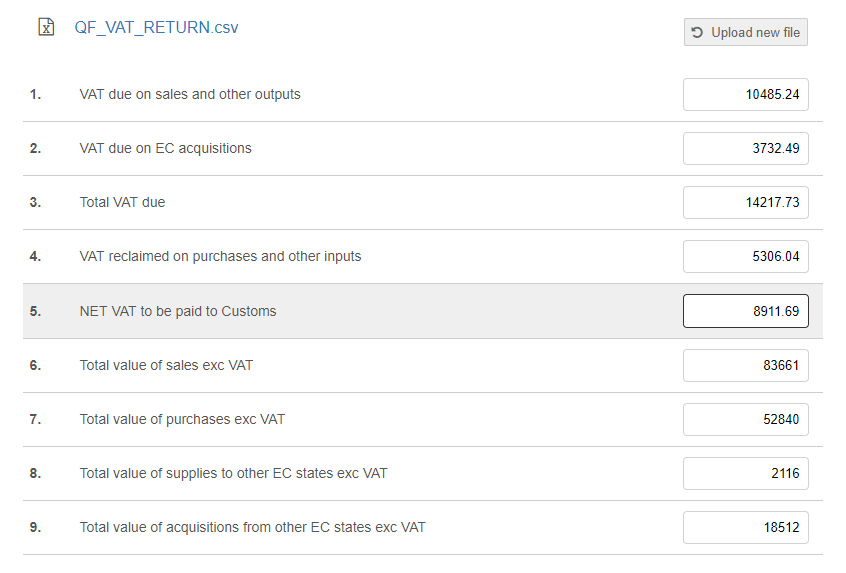

- Once you’ve setup all your spreadsheet mappings click to save the form and return to the VAT Return screen. You may now upload your spreadsheet report by dragging it into the upload box or clicking to browse your hard drive. If your mappings are correctly aligned to your uploaded file the VAT return values will be bound to the relevant boxes:

- If you are happy with the figures on the preview of your VAT Return you can go ahead and submit them to HMRC.

Warning: Please carefully check all the values on your VAT Return before submitting. Ensure that all the values are aligned to your VAT backing report.