Introduction

When you have an automated bank feed running on your account, you rarely need to worry about balance reconciliation. The transactions are automatically pulled from your bank so will always be aligned. If however, you’re manually marking invoices as paid then there may be some extra work to get everything balancing. This is where bank reconciliation comes in.

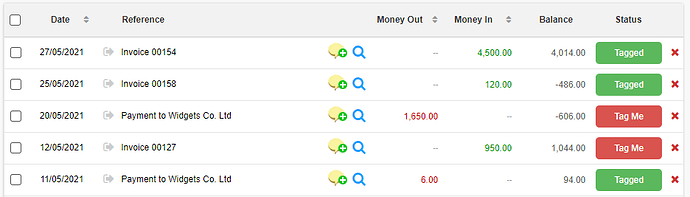

When you view your bank statement you will be able to see if your transactions are tagged. When a bank transaction is tagged it means that it is accounted for in QuickFile and is linked to an invoice, purchase, transfer or other financial transaction within your business. When completing a period of your bookkeeping the objective is to ensure that all your bank transactions have been tagged and matched against your paper statement.

Find out more about the bank tagging process

The two methods for bank reconciliation

There are essentially two approaches to completing your bookkeeping and reconciling your bank in QuickFile. Some people prefer to use QuickFile as a day-to-day management tool and others prefer to complete their bookkeeping retrospectively. The approach you choose will determine how you reconcile the bank.

Scenario 1

QuickFile allows you to upload a spreadsheet file (CSV format) that contains all your transactions for a given period. These files are downloaded from your online banking service provider. When you upload a period you can be sure that your start and end balances will match and you’re only concerned with the process of tagging all your transactions. The tagging process will build all your double-entry bookkeeping records on the fly. Invoices, purchases, salaries, and tax payments are all created from the bank tagging wizard. When all your transactions are highlighted green and the open and closing balances match, you have a reconciled bank account!

Scenario 2

This method is suited to those who are using QuickFile on a day-to-day basis to manage their books. This means you are logging into QuickFile to create new invoices, mark as paid and log your receipts and expenses. As you mark purchases and sales as paid the banking transactions are automatically dropped into the appropriate bank account. At the end of the month your statement in QuickFile may not resemble your actual paper statement exactly.

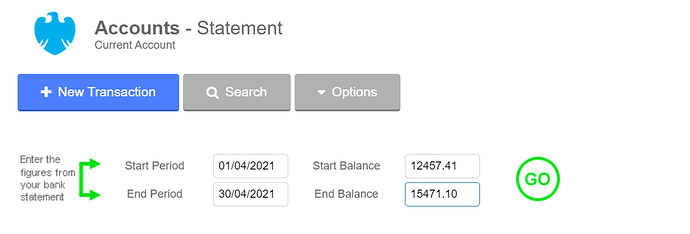

If you click on the “Options” menu followed by “Reconcile” within your bank statement view, you can key in the opening and closing balances from your statement. QuickFile will then check to see what has been entered and work out any difference that may exist. You can scroll through your statement to see when the balance becomes out of sync and enter the necessary transactions to bring it back inline.

You can also use a combination of the above two methods to reconcile your bank. The ‘match transactions’ tool will allow you to ensure your transactions are always synchronised with your bank.

Locking Transactions

QuickFile will lock a transaction when it has been reconciled in a VAT Return or you have completed the Year-End process. You can also manually lock your accounts to a specific date in Account Settings >> Account Lock.